(770) 344-0172

(770) 344-0172

Mar 09, 2023

Who is SVB Financial?

SVB Financial is the parent of Silicon Valley Bank, a financial holding company based in California. Its market capitalization was close to $20 billion before today. Now it is less than $10 billion. The company has total assets of roughly $200 billion.

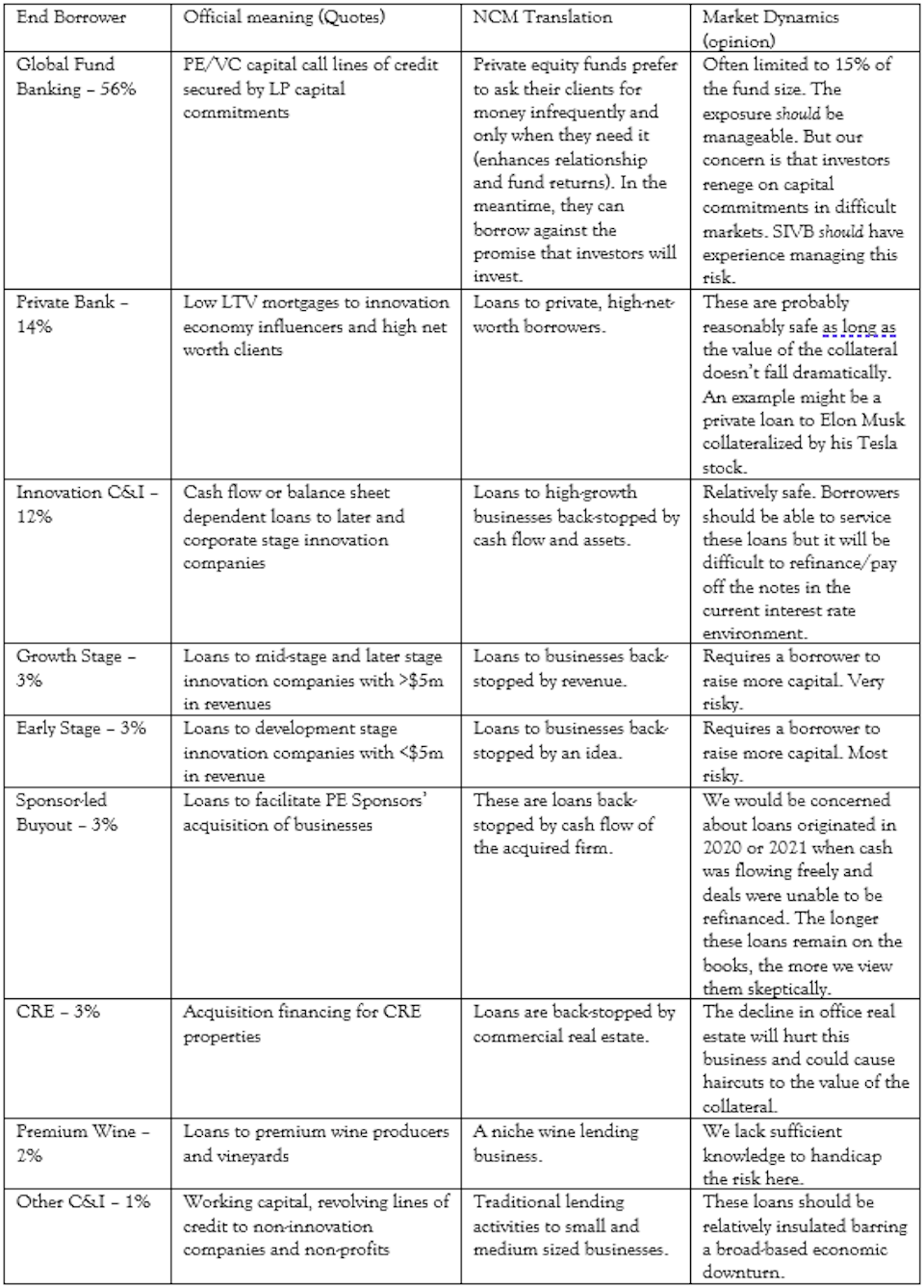

They offer funding to a variety of borrowers. According to its presentation this morning, the loan book was apportioned as follows at the beginning of 2023:

What happened?

1) Clients continued to spend money, drawing down their deposits.

a. Lower levels of deposits reduced Silicon Valley’s asset and funding base, requiring it to raise more capital.

b. Client cash burn remains ~2x higher than pre-2021 levels and has not adjusted to the slower fundraising environment.

2) SVB Financial is re-engineering its investment portfolio.

a. Banks hold some cash as “Available for Sale” (AFS). This cash is invested in liquid assets. At least, they are supposed to be liquid. They entailed $21 billion in US Treasuries and Agency securities with a 3.6-year duration. This is quite a bit longer than you’d ideally want. But because interest rates were so low, SVB clearly wanted to enhance its return profile and invested in longer-maturing securities.

b. The rapid rise in interest rates resulted in a portfolio that looked terrible in the current environment. The portfolio today yields just 1.79%.

c. As a result, SVB is deciding to liquidate this portfolio and reinvest it at higher rates. To do this, they incurred a $1.8 billion post-tax loss. The new portfolio will consist of short-duration US Treasuries. They will further increase exposure to rising interest rates with a portfolio of receiver swaps (esoteric financial instrument where one entity trades a guaranteed fixed rate in order to receive whatever the prevailing interest rate is at the time).

3) As a result of the falling deposit base and the re-engineered portfolio, SVB needs to raise capital to bolster its balance sheet.

a. Raising $2.25 billion in equity

Why did this happen?

SIVB is conflating two issues – continued high spending by borrowers and rising interest rates. Our view is that high spending by borrowers resulted in a deteriorating balance sheet. As this happened, SIVB likely realized that it would need to raise more capital.

When faced with that potential, rather than do a smaller equity offering and try to limp along with a subpar AFS portfolio, they determined to fix the portfolio at the same time. As a result, assuming the SIVB offering goes through tonight (which is not an insignificant “if”), the company should be in relatively good shape going forward.

What will happen next to SIVB?

In our view, this is a needed move for SIVB. While we are concerned they are betting too much on rising interest rates after the event has already taken place, the move isn’t terrible. It is probably an overcorrection, but at least they realized the error of their former ways.

As a result of the equity injection, SIVB is appropriately raising cash to prevent a forced liquidation. While we can’t rule out further deterioration of the portfolio, they have reduced the risk of a near-term solvency event.

Going forward, even while the balance sheet is in good shape, issues with the portfolio remain. The company did not change its estimate of loan charge-offs, which remain at very low levels (0.15%-0.35%). And while they had expected lower Venture Capital investment, they did not appear to significantly reduce their estimate here. That is critical because venture capital is the “get out of jail free” card for SIVB. It provides capital infusion to companies which can be used to pay off SVB loans.

What is the risk of contagion (like in 2008)?

As of now, we believe the risk of contagion is relatively low in public markets. In the near term, we would anticipate:

1) Stricter lending standards from companies like SIVB, reducing the capital available to smaller unprofitable technology upstarts.

2) A more intense focus on costs from SIVB borrowers (and others). This could have negative impacts on the advertising market, commercial real estate in tech hubs, and employment.

3) Slower activity in private markets. If you run a small/medium-sized business and are hoping for a PE buyout or a capital infusion, think again. Run lean. Conserve your cash and make sensible decisions.

At the same time, the fact SIVB is able to raise equity capital (albeit at a substantial discount) should be an encouragement. In 2008, banks were unable to do this and had to be bailed out by the US Government and other financial institutions.

Tight lending markets are ultimately the transmission mechanism for the Federal Reserve to lower inflation when they reduce the money supply. So the ultimate impact here shouldn’t really be a surprise. Of course, as it is said, risk happens slowly, then all at once.

Conclusion

Bottom line: SIVB’s collapse will have near-term implications in private equity and unprofitable technology-focused industries. However, for now, the risk of contagion is relatively limited, in our view. We reserve the right to change our opinion when the facts change.

Chief Investment Officer, Portfolio Manager

Ben arrived at Narwhal from a small investment firm in Eugene, Oregon, where he cut his teeth investing in individual stocks, bonds and derivatives. He earned the right to use the CFA designation in 2016, holds his Series 65 license and is a certified Financial Risk Manager. Ben received a bachelor’s degree in finance from the University of Washington and a MBA from Emory University's Goizueta Business School. In his free time, he plays competitive tennis, mentors for Mentoring for Leadership and is a frequent contributor to The Investing Podcast.

At Narwhal Capital Management, you’re more than just a portfolio, and it’s not all about the numbers. Let’s start with a meeting about your needs and future goals.