(770) 344-0172

(770) 344-0172

Jun 30, 2022

Intro:

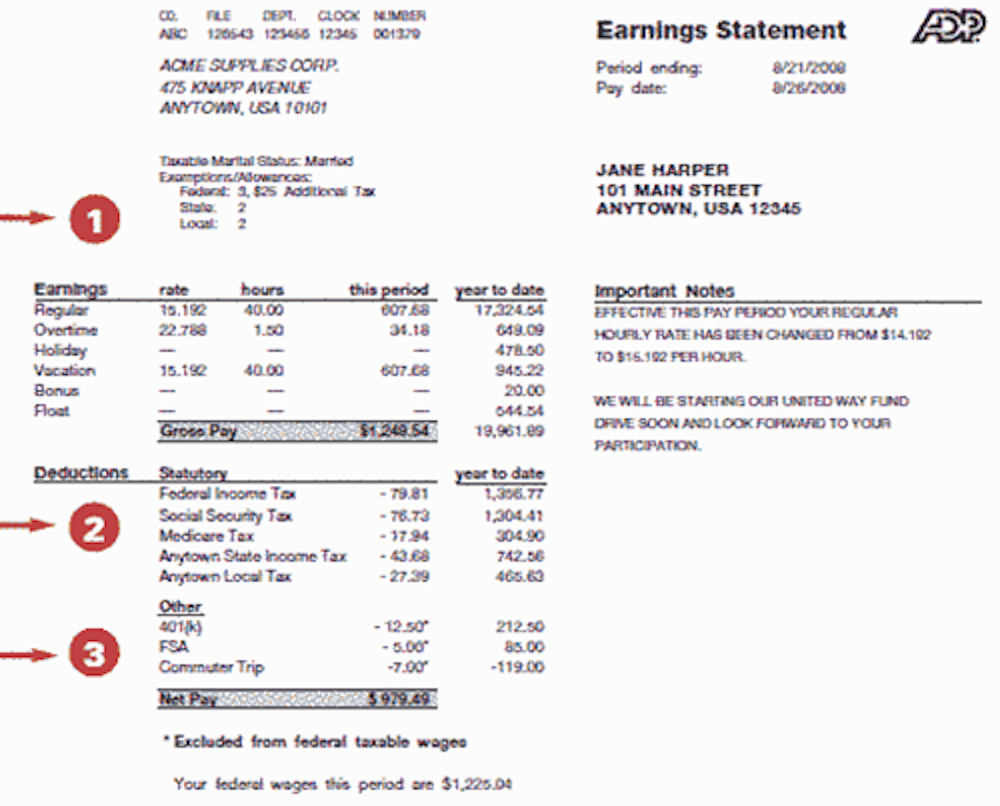

Oftentimes, people do not know what is included in their paystub which can lead to missing errors and not fully understanding what benefits and deductions you have with your employer. This post serves as a guide for understanding your paystub and some of the common line items found within it.

1. Personal Information & Earnings

Earnings

2. Deductions

3. Other Deductions (some deductions not listed in image above)

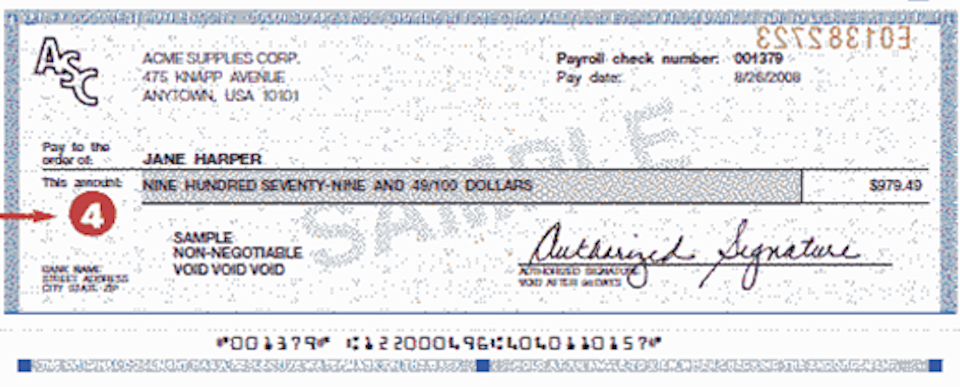

4. Net Pay

Sources:

https://measuretwicemoney.com/how-to-review-a-pay-statement/

Financial Planning Associate

Melissa came to Narwhal in the summer of 2018 following the completion of her master’s degree in financial planning from the University of Georgia, where she also earned her bachelor’s degree in consumer economics. Her interest in the field started with learning about consumer behavior, specifically its relation with complex moneymaking decisions. Melissa recently received her CFP® Certification in January 2021. Working with a CFP® professional can help you find the path to achieving your financial goals. Your goals may evolve over the years as a result of shifts in your lifestyle or circumstances such as an inheritance, career change, marriage, house purchase , or a growing family. Melissa is here to help you through that process. When she’s not working, Melissa enjoys cycling, cooking, and spending time with her beagle and two nieces.

At Narwhal Capital Management, you’re more than just a portfolio, and it’s not all about the numbers. Let’s start with a meeting about your needs and future goals.