(770) 344-0172

(770) 344-0172

Jan 25, 2023

As tax time rolls around, the inevitable question of “What can I do to save on taxes?” starts popping up more and more. For those that own their own business, the answer may well be to setup a company retirement plan.

Thanks to the SECURE Act and the recently passed SECURE 2.0, the maximum tax credit for qualified startup costs of a qualified plan have increased from $500 to $5,000. Additionally, the employer is eligible for a $500 credit by adding an automatic enrollment feature to a new or existing 401(K) plan. These credits are available for the first 3 years of the plan for a maximum credit of $16,500 ($5,500 per year for 3 years)

The primary eligibility requirements for this credit are that the employer has at least one non-highly compensated employee and less than 100 employees that made over $5,000.

What types of plans may qualify?

Non-qualifying plans:

What is a qualified startup Cost?

According to the IRS, you may claim the credit for ordinary and necessary costs to:

Additionally, certain employer contributions for a plan's first five years now may qualify for the credit. The credit is increased by a percentage of employer contributions, up to a per-employee cap of $1,000: It is 100% in the plan's first and second tax years, 75% in the third year, 50% in the fourth, and 25% in the fifth. For employers with between 51 and 100 employees, the contribution portion of the credit is reduced by 2% times the number of employees above 50.

In addition, no employer contribution credit is allowed for contributions for employees who make more than $100,000 (adjusted for inflation after 2023). The credit for employer contributions also is not available for elective deferrals or contributions to a defined benefit pension plan.

How do I go about starting a plan and administering it?

That is why Narwhal is here to assist. Our 401(K) administration team headed by Luke Burton ([email protected]) would be happy to discuss plans and tailor one that fits your needs. Employers can now adopt a plan as late as the tax filing deadline, including extensions, for the taxable year rather than by the last day of that taxable year.

In the hyper competitive job market, providing a retirement plan to your employees will be a differentiator for your business and will give you an upper hand in attracting and retaining top talent.

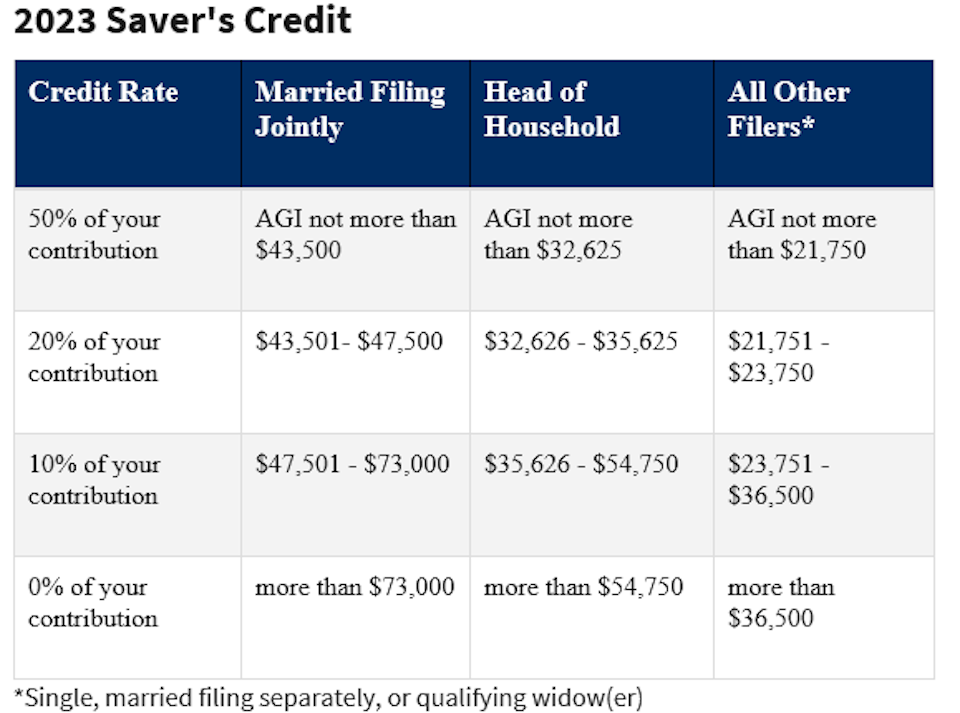

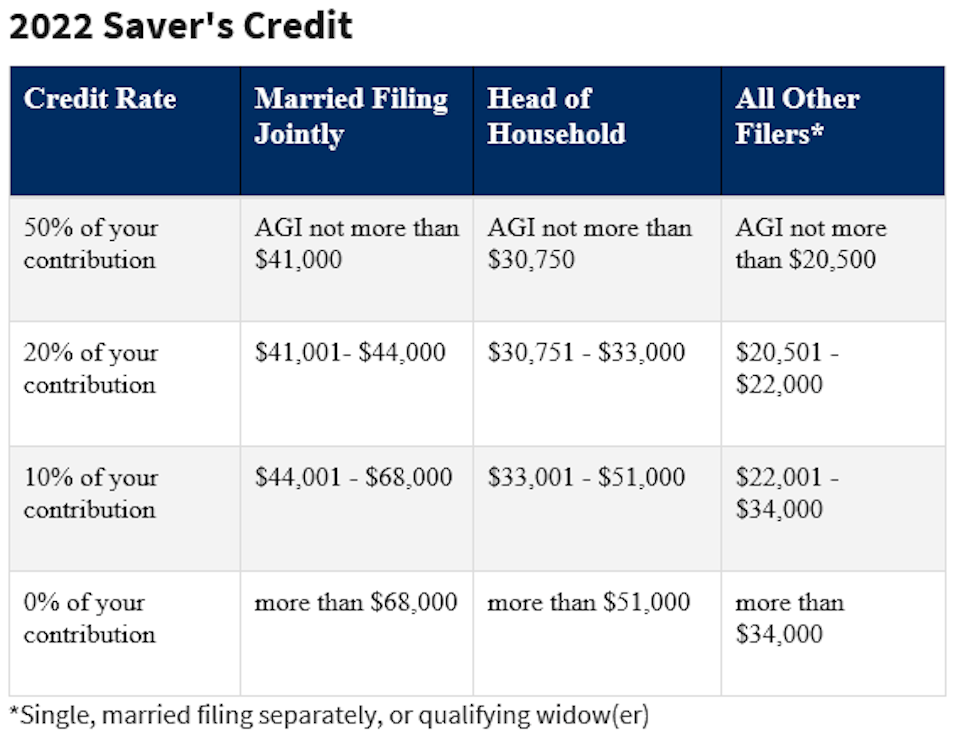

Possible Additional Benefit for Employees

Who's eligible for the credit?

You're eligible for the credit if you're:

Amount of Credit:

Tax and Accounting Associate

Donald joined Narwhal in February of 2021. He brings 15 years of experience in tax compliance and consulting in public accounting specializing in high net worth individuals and their related businesses along with commercial real estate taxation. He received both his BA in Accounting and his Masters in Taxation from Georgia State. Donald is very active as a member of the Grand Lodge of Georgia Free and Accepted Masons. In his free time, you can most likely catch him with a line in the water, either on Georgia's lakes or offshore marlin fishing in Cabo San Lucas.

At Narwhal Capital Management, you’re more than just a portfolio, and it’s not all about the numbers. Let’s start with a meeting about your needs and future goals.