(770) 344-0172

(770) 344-0172

Oct 14, 2022

Health Insurance Options (Part 3):

In the third part of the insurance series, we are discussing health insurance options.

First, you must determine what you are eligible for when it comes to health insurance.

Are you eligible for Medicare?

If yes, insurance offered through Medicare is an option. You should take into consideration whether you or your spouse are eligible through a group health insurance plan before enrolling in Medicare.

If no, you should explore options given to you by your employer (group or retiree health insurance). Shopping the Health Insurance Marketplace can also offer you coverage until you are eligible for Medicare. We do not provide recommendations when it comes to which type of plan to get, but we have a referral who can assist you if you are interested in learning more.

It is also important to know that you may enroll in COBRA for specific reasons (i.e., retiring if group plan had more than 20 employees), which is a continuation of your group health insurance policy up to a certain amount of months, but you will incur the full cost (your portion and the employer’s portion), plus a small fee.

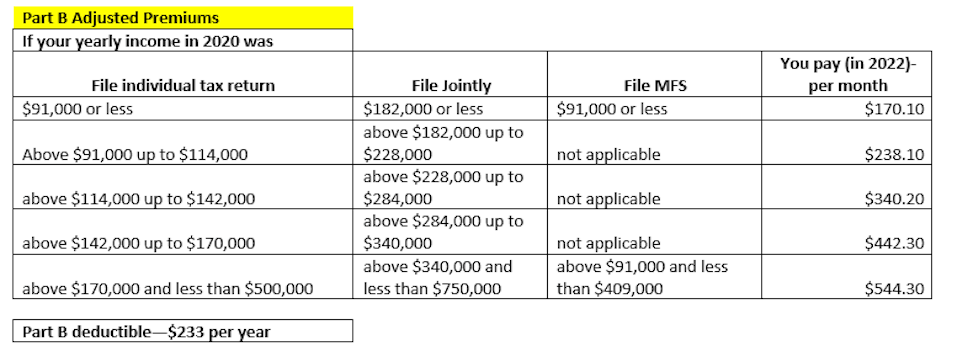

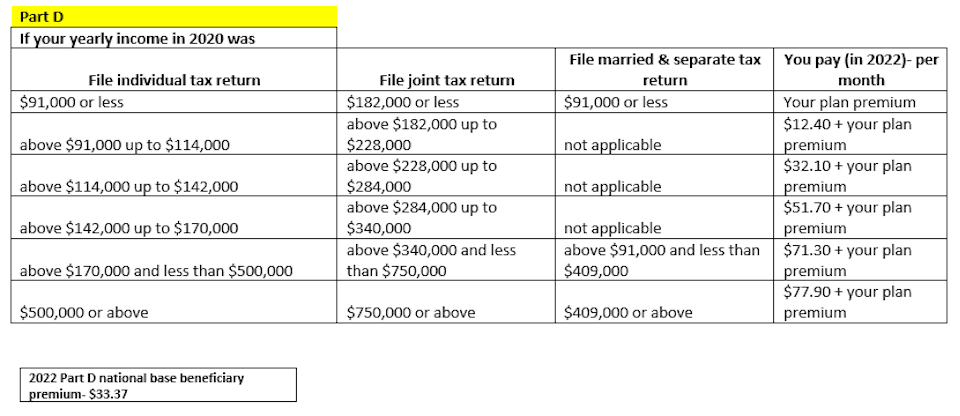

Below is more information regarding Medicare and the key things to know before you shop for supplemental or Advantage plans.

Medicare Planning

Healthcare planning is a key part of the overall retirement planning process. There are several ways that retired individuals can pay for health care. For the majority of Americans aged 65 and older, most health care is provided through the various elements of the federal government’s Medicare programs.

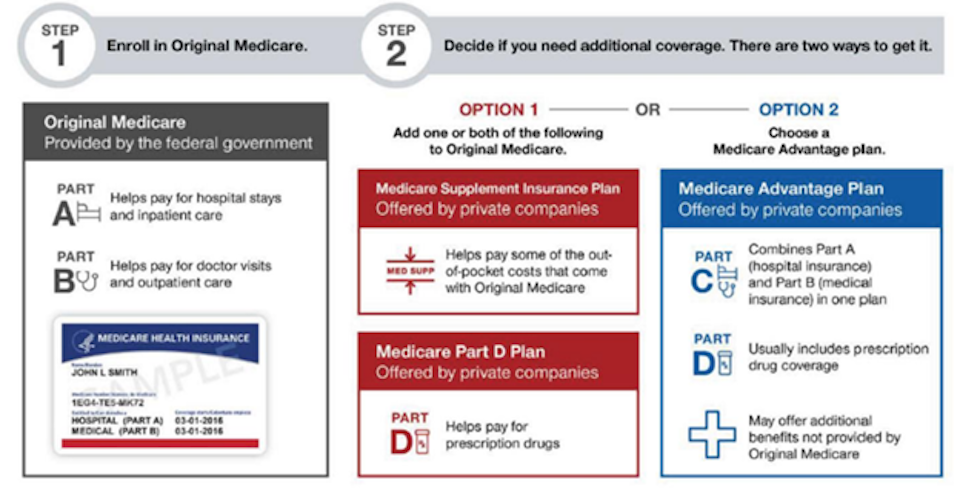

What Does Original Medicare Cover?

Beyond Original Medicare

Part D

Part C (Medicare Advantage)

Medicare Supplement (Medigap)

That means there are two routes to fill the Original Medicare gaps.

1. Medicare supplemental +Part D

2. Medicare Advantage

Financial Planning Associate

Melissa came to Narwhal in the summer of 2018 following the completion of her master’s degree in financial planning from the University of Georgia, where she also earned her bachelor’s degree in consumer economics. Her interest in the field started with learning about consumer behavior, specifically its relation with complex moneymaking decisions. Melissa recently received her CFP® Certification in January 2021. Working with a CFP® professional can help you find the path to achieving your financial goals. Your goals may evolve over the years as a result of shifts in your lifestyle or circumstances such as an inheritance, career change, marriage, house purchase , or a growing family. Melissa is here to help you through that process. When she’s not working, Melissa enjoys cycling, cooking, and spending time with her beagle and two nieces.

At Narwhal Capital Management, you’re more than just a portfolio, and it’s not all about the numbers. Let’s start with a meeting about your needs and future goals.