(770) 344-0172

(770) 344-0172

May 05, 2022

Reasons for Making a Charitable Gift:

There are numerous ways to give to charities. Below are Narwhal’s most popular strategies when it comes to charitable giving.

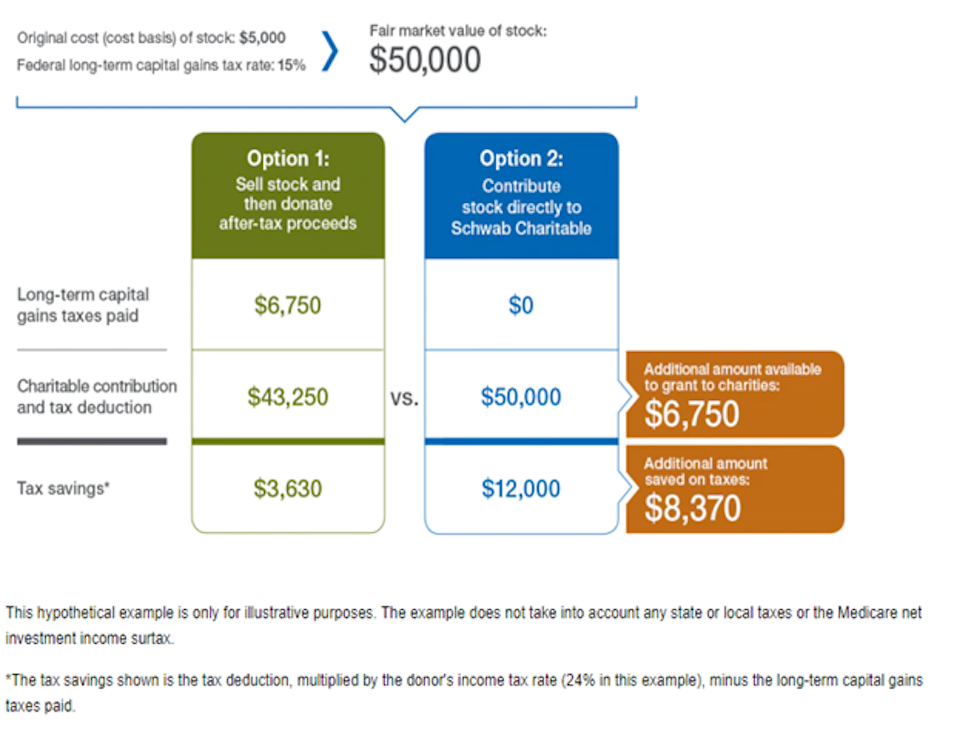

1. Give appreciated non-cash assets instead of cash

This strategy is advantageous for those who itemize their tax deductions. In addition to claiming a deduction for the fair market value of an asset, donors can potentially eliminate the capital gains tax they would otherwise incur if they sold the asset and donated the cash proceeds. This results even more going to the charity and less to taxes. See example in figure 1 below.

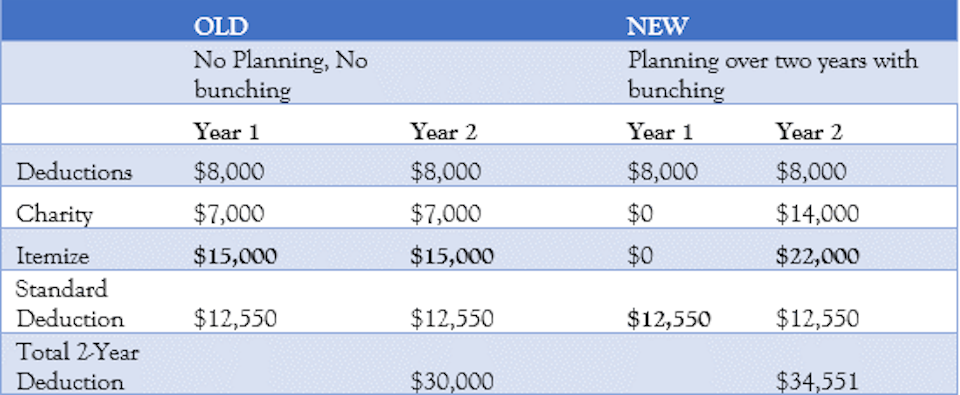

2. Bunch itemized deductions

Some donors may find that the total of their itemized deductions for a certain tax year will be slightly below the level of the standard deduction. You may find it beneficial to bunch two tax years of charitable deductions into one year and take the standard deduction on the other year. See example of bunching in figure 2 below.

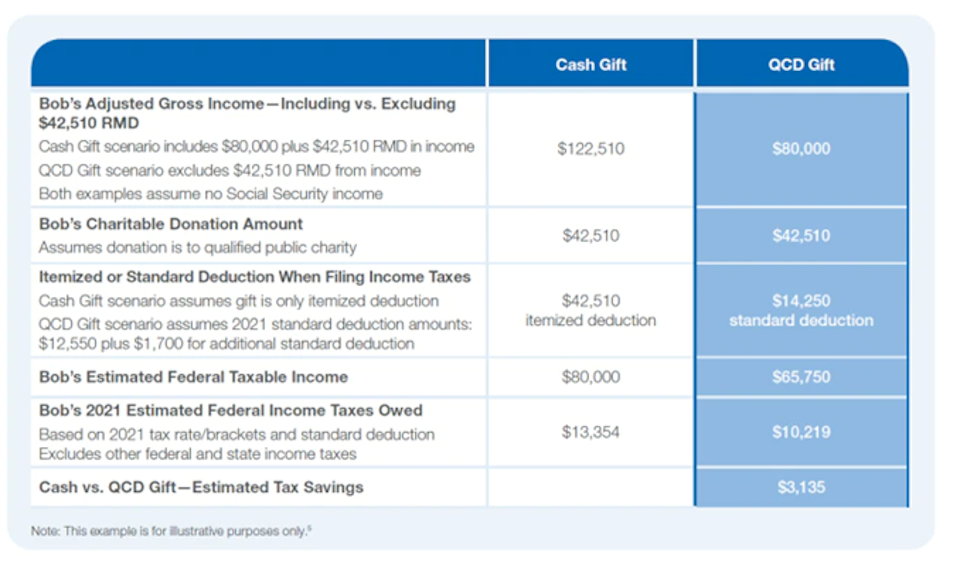

3. Make a Qualified Charitable Distribution of IRA assets

Whether you itemize or claim the standard deduction, if you are age 70 ½ or older, you can direct up to $100,000 per year tax-free from your Individual Retirement Accounts (IRAs) to operating charities through QCDs. By reducing the IRA balance, a QCD may also reduce the donor’s taxable income in future years, lower the donor’s taxable estate, and limit IRA beneficiaries’ tax liability. See below for an example of a QCD and the tax implications of such.

As an example of the potential tax savings of a QCD, consider a hypothetical donor, Bob, who is a single tax-filer with anticipated ordinary income of $80,000 in 2021. Bob is 73 years old in 2021 (which means he falls under the old RMD rules) and takes a distribution from his traditional IRA. In this instance, Bob's IRA is valued at $1,050,000, resulting in a projected RMD of $42,510 ($1,050,000 divided by the IRS mandated age 73 distribution period amount of 24.7). The figure 3 below for an illustration comparing a cash gift of $42,510 with a QCD for $42,510.

Sources:

https://www.schwabcharitable.org/non-cash-contribution-options/making-qcds

https://www.schwabcharitable.org/maximize-your-impact/2021-strategies

Index:

FIGURE 1: Donating vs Selling Appreciated Stock Positions

FIGURE 2: Tax Benefit of Bunch Itemized Deductions

FIGURE 3: Qualified Charitable Distributions of IRA Assets

Financial Planning Associate

Melissa came to Narwhal in the summer of 2018 following the completion of her master’s degree in financial planning from the University of Georgia, where she also earned her bachelor’s degree in consumer economics. Her interest in the field started with learning about consumer behavior, specifically its relation with complex moneymaking decisions. Melissa recently received her CFP® Certification in January 2021. Working with a CFP® professional can help you find the path to achieving your financial goals. Your goals may evolve over the years as a result of shifts in your lifestyle or circumstances such as an inheritance, career change, marriage, house purchase , or a growing family. Melissa is here to help you through that process. When she’s not working, Melissa enjoys cycling, cooking, and spending time with her beagle and two nieces.

At Narwhal Capital Management, you’re more than just a portfolio, and it’s not all about the numbers. Let’s start with a meeting about your needs and future goals.